FBR Digital Invoicing Integration Software for B2B and B2C Businesses in Pakistan

A complete FBR digital invoicing system designed for seamless integration with ERP systems through the PRAL API.

Our solution enables businesses to automate digital invoicing, track real-time sales, and ensure compliance with Pakistan’s tax laws.

It is built for tax consultants, manufacturers, wholesalers, retailers, and enterprises that require certified FBR digital invoice integration through a licensed integrator.

Special discount offer available for tax consultants.

What Makes Our FBR Integration Software Stand Out

- Real-Time Sales Sync with FBR

- Integration with PRAL Tax Filing Portal

- Automated Sales Tax Invoicing

- POS System Compatibility

- Compliant with FBR’s e-Invoice Regulations

- Auto-Generation of QR-Coded Invoices

- Monthly Tax Reporting & Filing

- Multi-Branch & Multi-Terminal Support

- Customer & Supplier Ledger Tracking

- Offline Mode with Auto Sync

- Fuel Dispenser Integration (For Petrol Pumps)

- Support for Discounts, Returns & Adjustments

- Secure Invoice Storage & Retrieval

- User Access Control & Audit Trails

- Support for Urdu/English Invoicing

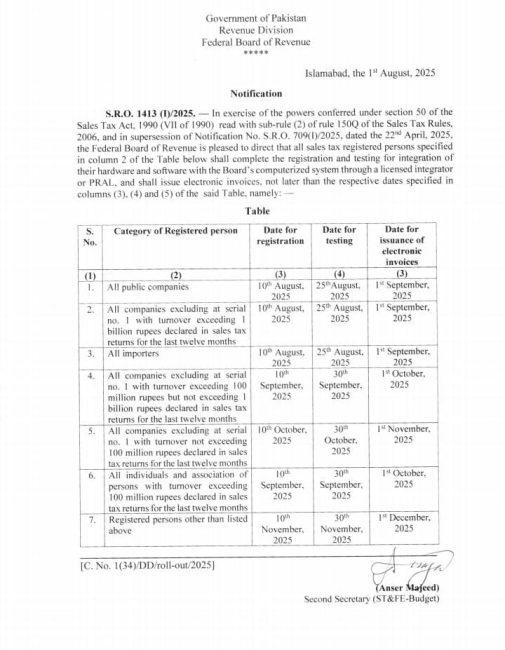

The Government of Pakistan has made it mandatory for all retailers to install FBR-integrated Point of Sale (POS) systems at their outlets. This includes generating and reporting digital invoices for both B2B (Business-to-Business) and B2C (Business-to-Consumer) transactions using a valid FBR registration number. Many businesses are struggling to find a reliable, easy-to-use POS software that works seamlessly across cloud and desktop environments.

Solution

Introducing Pakistan’s Best Free POS Integration Software — a complete business management solution that supports both B2B and B2C invoicing. Our system empowers businesses to comply with FBR’s e-invoicing requirements by automatically recording every sale and purchase in real-time, regardless of transaction type. Easily prepare monthly tax returns, send automated alerts, track financials, and generate one-click reports — all from a single platform. Designed for petrol pumps, textile industry, logistics and transportation business, retailers, wholesalers, and tax consultants, our software makes FBR integration, sales invoicing, and tax compliance effortless and efficient for all business types.

Highlights of Our FBR-Compliant Invoicing Software

Integration with FBR PRAL Portal

Setting of Different Sale Tax Percentages on the bases of Products

Sale invoicing with automatic sale tax invoice number

Deduction and Adjustment of Sale Returns

SMS sending to customers feature

Real Time Sales Tax Reporting and Tax Filling

Industries We Serve

Our FBR-compliant digital invoicing software is built to serve a wide range of industries across Pakistan. Whether you’re in retail, wholesale, or manufacturing, our system adapts to your business operations—ensuring seamless integration with FBR’s Digital Invoicing System for both B2B and B2C transactions.

- Oil and Gas

- Textile

- Manufacturing

- Logistics and Transportation

- Hospitality

- Construction

- Real Estate

- Small and Medium Businesses

📌 Need a custom module? We’ll tailor it to your workflow.

DigitalManager provides digital invoicing integration services with the FBR IRIS portal and PRAL system

DigitalManager FBR Integration software service stands out as a comprehensive and versatile solution, offering a one-stop-shop for businesses across diverse industries. Its unique strength lies in its seamless integration with various industrial software systems, providing a harmonized and efficient operational experience. Whether in retail, manufacturing, or service-oriented sectors, Our software ensures a unified platform that streamlines business processes. This software excels not only in its ability to integrate with existing systems but also in its adaptability, making it an ideal choice for businesses seeking a versatile and all-encompassing solution. With its compatibility and integration capabilities, DigitalManager FBR POS Integration emerges as a reliable and flexible choice for enterprises looking to optimize their workflows and enhance overall operational efficiency.

You may track usage, monitor changes in unit Rupee costs, determine whether to place a new order, and examine inventory levels item by item with our Retail Management System. Every sale is tracked by our POS software, ensuring your inventory data is always up to date. It automatically sends tax details to relevant authorities through its real-time tax integration module. Its powerful dynamic reporting enables you to monitor your financial information with ease. As a leading provider of POS software in Pakistan, we also offer complete tax integration and registration support services.

Get started with our FBR digital invoicing software and integrate it with your ERP or Point of Sale today.

Frequently Asked Questions (FAQ)

It’s a comprehensive digital invoicing system that seamlessly integrates POS or ERP systems with Pakistan’s FBR IRIS/PRAL portal, enabling automated real-time sales invoicing for both B2B and B2C transactions

The software is tailored for retailers, wholesalers, petrol pumps, textile, manufacturing, logistics, transportation, hospitality, construction, real estate, SMEs, and tax consultants.

- Integration with FBR PRAL portal via API

- Automatic sales tax invoice numbering

- Support for various tax percentages per product

- Returns handling with adjustments

- Real-time tax filing and reporting

- SMS alerts to customers

It works across both cloud and desktop POS/ERP environments, automatically capturing every sale and purchase, sending tax data to FBR and enabling unified reporting from one platform

the system records transactions in real-time, automates monthly tax return preparation, generates tax reports, and integrates tax-filing through FBR portal.

Yes, the software sends SMS alerts to customers for invoices, updates, promotions, and alerts.

Absolutely—it includes modules specifically designed for industries such as oil & gas, wholesale, retail, manufacturing, logistics, hospitality, construction, real estate, and more.

The system tracks inventory in real-time, updates stock levels with each transaction, monitors costs, and supports order planning and reorders.

DigitalManager has offices in Lahore, Islamabad, Karachi, and Faisalabad, suggesting nationwide reach and support in Pakistan

You can request free consultancy or a live demo by contacting any of their regional offices or via email and phone listed on their site.

Step-by-Step Integration Process with FBR Digital Invoicing System

1. Sign Up & Onboard

Register with our team to begin the onboarding process and get assistance in preparing your business for FBR e-invoicing integration.

2. Get API Access & Credentials

Receive secure API credentials through PRAL (Pakistan Revenue Automation Ltd) to begin integrating your software with FBR’s system.

3. Connect Your ERP or POS System

Integrate your existing ERP, POS, or accounting software with our solution using the provided FBR-compliant API endpoints.

4. Perform Sandbox Testing

Run your invoicing system in FBR’s sandbox environment to ensure accurate data exchange and compliance before going live.

5. Go Live with Real-Time Integration

Once approved, switch to live mode. Your sales invoices will now be sent in real time to FBR through the IRIS/PRAL portal.

6. Automated Invoice Generation

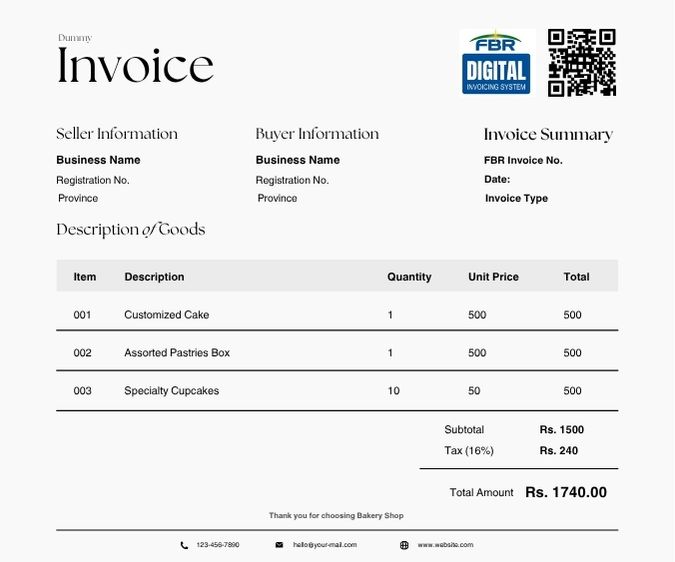

Each transaction auto-generates a digital invoice in FBR-approved format — complete with serial numbers, QR code, and tax details.

7. Real-Time Data Sync with FBR

Invoices are submitted instantly to FBR’s portal, ensuring transparency and immediate tax reporting with zero manual effort.

8. Monitor & Manage Sales

Use our integrated dashboard to view sales activity, invoice history, tax amounts, and branch-wise reporting in one place.

9. Monthly Tax Reporting & Export

Effortlessly generate monthly tax summaries and downloadable reports for seamless filing and compliance.

10. Customer Notifications (Optional)

Enable SMS notifications for customers to confirm transaction and invoice details — increasing trust and transparency.

11. Stay FBR Compliant

Our licensed integration ensures your business meets all regulatory requirements for digital invoicing under Pakistan’s tax laws.

FBR Digital Invoicing User Manual PDF

This user manual provides a step-by-step guide on how to generate and manage digital invoices using the FBR (Federal Board of Revenue) system in Pakistan. It covers user registration, invoice submission, integration methods, and compliance requirements for businesses. Ideal for taxpayers, tax consultants in Pakistan, developers, and finance professionals who need to comply with FBR digital invoicing regulations.

Download Here: FBR Digital Invoicing User Manual PDF